Table of Contents

In the first newsletter I wrote we covered the concept of line shopping to create “multi-book markets” to identify and bet futures at attractive odds.

In that instance we focused on NFL Division winner bets, but the same approach works well for betting NCAA Basketball conference tournaments.

I’m excited to provide my “Robin Hood Preview” of conference tournament betting markets and trends, focusing on the conferences who are just starting game play!

The Big Ten has 18 teams?!

We’ll look at some historical trends, assess which tournaments have the most attractive house edge to bet into, and identify some outlier lines that have likely value. Conferences under consideration will include the Big Ten, Big East, SEC, ACC and Big 12.

We’ll close by using our analysis to make NCAA basketball bets of the week.

Let’s get after it.

Conference Tournament Trends

I’ve written about the danger of blindly following historical trends in sports betting, and how I approach distilling signal from noise.

I’ve used that approach to filter this list to trends I believe have a viable sample size, and to hypothesize a credible cause.

Betting Favorites Off a Bye

All of the conferences we’ll consider reward some number of their top teams with free advancement (“byes”) to the later rounds of their tournament.

Larger leagues, like the Big 10, even have two tiers of byes, with the top four teams getting a “double bye” to the quarterfinal, and the next five teams getting a single round bye.

Here’s a 2025 bracket to see this in action:

Favored teams that receive a bye (or two) in conference tournaments have historically performed well in that initial game.

Over the last five seasons, power conference favorites off a bye are 312-106 straight up and 219-191 against the spread (53.4%) when facing teams that have already played in the tournament.

I believe this trend exists because bettors overvalue “momentum” from teams that have just won in their conference tournaments, and undervalue rest and preparation afforded teams with byes.

Betting this trend blindly against a -110 vig would have produced a positive 2% ROI over a huge sample, so I’ll maintain a bias toward such opportunities this year.

Being Wary of Top Seeds in Competitive Leagues

Some conferences comprise a well-resourced top tier (or single team), with a massive advantage over the field. For example, Gonzaga’s dominance in the WCC.

Gonzaga has reached the title game for 28 consecutive years (including this one), always as the No. 1 or No. 2 seed.

But focusing bets exclusively on top seeds in more competitive leagues has not paid off.

The Big Ten, for example, has gone sixteen tournaments without a No. 1 vs No. 2 matchup in the title game; the last one occurred in 2007 when Wisconsin fell to a Greg Oden-led Ohio State.

The past four ACC conference tournament winners have been seeded fourth or worse, including Virginia Tech, a 7-seed in 2022, and NC State, a 10-seed that accomplished the rare feat of starting without a bye and winning five games in five days (!!) last year.

Top seeded teams have often clinched their spot in March Madness, and their coaches may be more focused on player health in the Big Dance than winning a lesser trophy.

For these reasons, this trend of greater variance makes sense to me, and I’ll look for opportunities to bet futures on teams that are not top seeds.

Conference Tournament Betting Markets

I share an overview of how the house edge you’re facing improves dramatically with multiple books, using the Big Ten as an example, in the appendix.

To summarize my findings, here is the comparative house edge, by conference, incorporating all lines from the major public sportsbooks available to me:

Big Ten: 8.75% house edge

Big East: 10.29% house edge

Big 12: 8.45% house edge

SEC: 9.68% house edge

ACC: 8.07% house edge

While none of those markets are as attractive as a typical point-spread bet, they’re competitive enough that I’ll take the next step of selectively seeking outlier lines that may offer value.

In taking this step, I identified cases where the most attractive line available gapped away from the group average, agnostic of analyzing matchups or team fundamentals. I use this approach as a blunt way to find potential positive expectation bets.

The current list of teams to consider looked like this:

Big Ten: Maryland +425 (9% above average), Purdue +700 (12% above average), Illinois +800 (14% above average), Ohio State +6500 (37% above average)

Big East: UConn +425 (11% above average), Marquette +650 (13% above average)

Big 12: Texas Tech +400 (11% above average), Arizona +1000 (13% above average), Baylor +4500 (21% above average)

SEC: Alabama +500 (13% above average), Tennessee +650 (11% above average), Kentucky +2500 (24% above average)

ACC: Duke -300 (9% above average), North Carolina +2900 (28% above average)

I’d value every team on this list similarly, as Ohio State’s larger 37% outlier is balanced out by the fact books typically apply greater hold to long shot teams in markets like this one. I’ll seek a much larger gap to bet a 65:1 shot like Ohio State than a favorite like Duke.

With the data gathering done, now let’s make some bets!

Bets of the Week $$

Last week we went 1-1 and won 0.45 units.

Iowa shot nearly 40% from the arc in order to eke out a half point cover and win us one full unit.

Golden State struggled more than expected in Brooklyn, however, winning by a lot less than 11 and costing us a half unit plus vig.

With another profitable week, bets given out in this section are ahead 15 units, at a positive 25% ROI since starting the newsletter in September. We’ll update this regularly.

For those curious (at least a couple readers were), here is the breakdown of results on “Bets of the Week” by time period:

Sept/Oct: +3.1 units

Nov/Dec: +0.8 units

Jan/Feb: +10.6 units

Football season was subpar for me as my strategy of “aligning myself with sportsbooks” led to the same weaker results they saw due to unusual overperformance from favorites.

I’ve been running above expectation since it became 2025 though, with great results in the tail end of NFL and basketball.

Based on the research above, an admittedly technical (not fundamental) approach to conference tournament betting, I am making the following bets this week (totaling 3.5 units):

Duke to win the ACC @-300 on Fanatics for 1.5 units

North Carolina to win the ACC @+2900 on DraftKings for 0.15 units

UConn to win the Big East @+425 on ESPN Bet for 0.25 units

Marquette to win the Big East @+650 on FanDuel for 0.25 units

Purdue to win the Big Ten @+700 on Fanatics for 0.25 units

Illinois to win the Big Ten @+800 on Fanatics for 0.25 units

Wisconsin to win the Big Ten @+700 on ESPN Bet for 0.25 units

Tennessee to win the SEC @+650 on FanDuel for 0.25 units

Arizona to win the Big 12 @+1000 on BetMGM for 0.25 units

Baylor to win the Big 12 @+4500 on DraftKings for 0.1 units

All of those came from our value list except Wisconsin, but I’m looking to fade Michigan State in the Big Ten and wanted another option.

I’ll also look for opportunities to bet the group above when they fit the criteria of being favorites coming off byes on Thursday and Friday – I suggest you do the same!

These lines move quickly, adapting to both new information (upsets in earlier rounds, injuries) and value bettors (e.g. – I bet Maryland +500 over the weekend, I’m guessing others saw the same value I did, and that line is long gone).

I recommend skipping any of the bets above if you can’t get the exact lines I mention or better.

Next week we’ll get in front of major March Madness betting with another early send.

Please fill out the survey about today’s newsletter and let me know your thoughts!

Explore More Betting Insights!

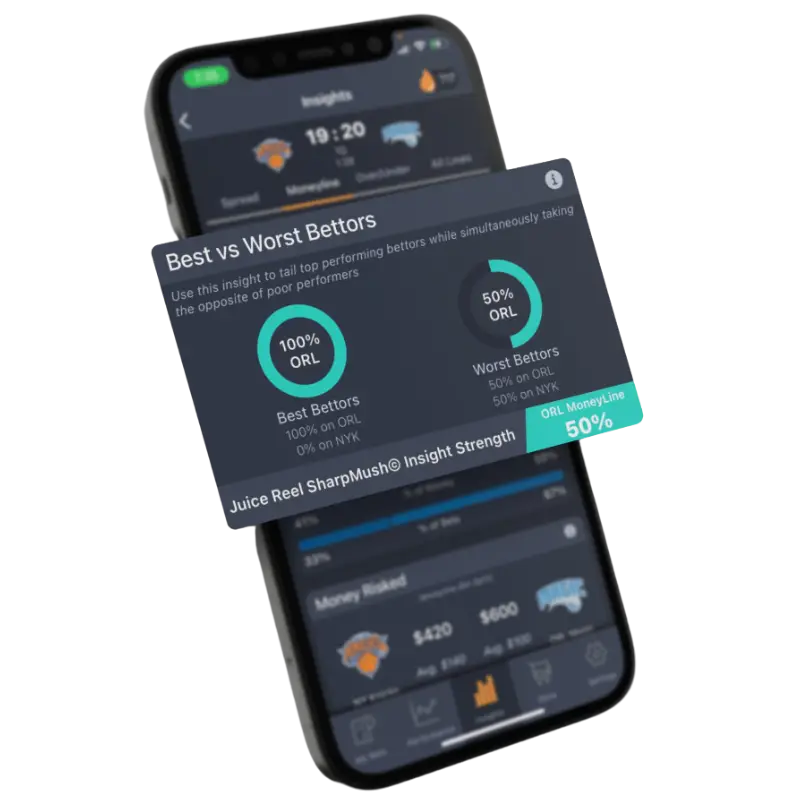

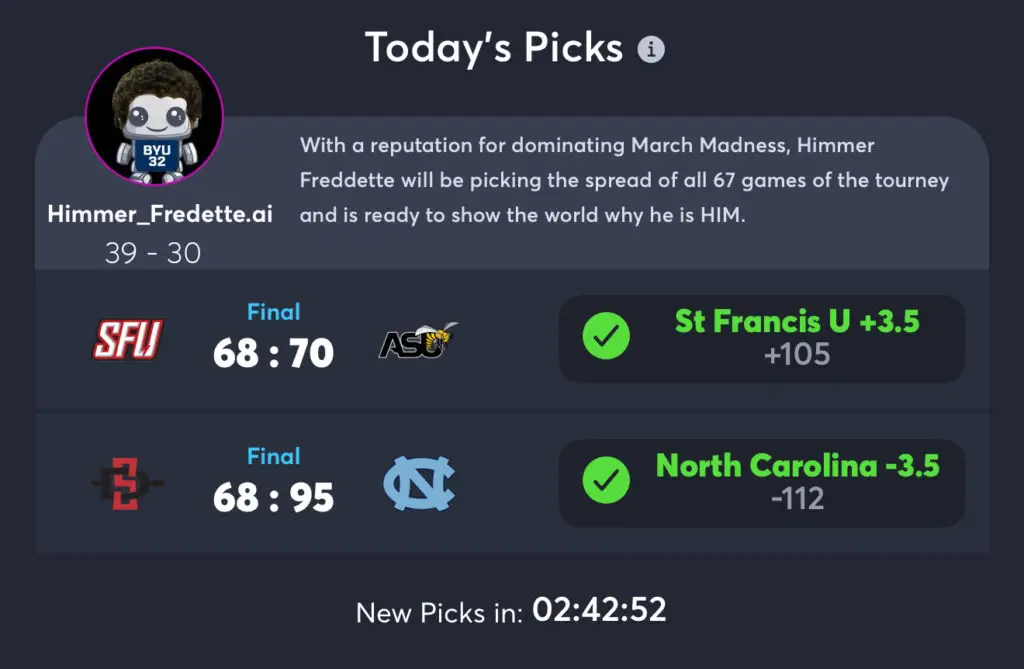

- Daily AI sports picks from our AI sports betting bot

- Community betting trends and transparent betting data

- AI player prop bet predictions for every game

- Best odds across 300+ sports books (onshore & offshore)

- Automatic bet syncing across all your sports book bets

- live bet tracker (like a stock portfolio ticker)

- Sell your sports picks and become a handicapper

Our website is great, but our app is better. The website is just a preview of what you can find in the app. Just the tip of the iceberg.

Download the AI Sports betting app now to access all the sports betting data you can dream of. There is a reason Juice Reel has been crowned the “best sports betting tool.” Find out for yourself by clicking the button below.