Table of Contents

Modern sportsbooks have innovated in ways both beneficial and harmful for bettors.

One such innovation is the “cash out” feature most sportsbooks offer, allowing you to exit a bet midstream and lock in a profit (or loss).

In a similar vein, bettors can hedge, or bet the opposite direction of their initial bet, in order to lower risk and guarantee a partial payout.

While both of these tactics typically reduce expected winnings – the big question is: do they ever create value for winning bettors?

When are the optimal situations to cash out or hedge, and how do savvy gamblers manage risk without giving up meaningful upside?

As the Robin Hood of sports betting, taking from the house and giving to the bettors, I’m eager to share what I’ve learned on this topic!

Can I truly let it ride on the Arizona Cardinals?

Today we’ll begin with broad concepts – what is hedging and what psychology is at play when considering these options. Then we’ll move to specific examples.

As always, we’ll close with our bets of the week on this weekend’s games.

Let’s get after it.

Cashing Out and Hedging 101

Cashing out and hedging serve the same purpose: to reduce future risk for a bettor, and lock in an outcome (frequently a profit).

Cashing out, the modern one-click innovation, is the more convenient option of the two, thought it is not always offered or available. The sportsbook will offer you a single price at which they will buy you out of your bet, and you can take it or leave it. Here is a visual:

Chiefs are a lock bro

Hedging involves making a second bet in the opposite direction of your initial bet, in order to capture some amount of value.

There are many forms of hedging. Common ones include: 1) betting against the last leg of your big parlay after winning all others, 2) betting against a team you own a futures bet on, in the playoffs, or 3) making a live bet against your team when they’re off to a hot start.

The Downside of Reducing Risk: Why NOT to Hedge

As we’ve discussed in prior newsletters, one of the best ways to become a winning bettor is to reduce the house edge you play against, minimizing the impact of the vig.

Hedging flies in the face of this goal because you must pay the vig at least twice, once on your initial bet, and again on the opposing hedge wager. Even if the line on your hedge bet is perfectly fair and neutral, you reduce expected value by hedging because you’re paying $11 to win $10 (or worse).

Because of this, hedging is typically bad strategy unless it’s part of a multi-step plan with a unique stimuli that justifies the extra transaction cost.

What might that look like?

Maybe you’re a $25 bettor but are granted a “100% profit boost promotion” that you’d like to max out with a $500 bet. In this case, the extra ~$200 of expected value from the promotion would more than cover the vig on a hedge bet.

Alternatively, you might find a fantastic line on a long shot team to win the NCAA title, but no way to bet them to make the Sweet 16 (your true prediction). In this case, make the first bet if the line is compelling enough, and plan your hedge for the second weekend of March Madness.

What about the “cash out” button? Cashing out is a similar drain on expected value because the books almost never offer you a fair price in their buyout offer.

Think of the cashout price offered as a less generous variation of the banker’s strategy on the show “Deal or No Deal”.

When two suitcases are left, one with $1M and one with $1, the game show player might be offered $425,000 to cash out. If you replaced that banker with a sportsbook cash out algorithm, they’d be offered even less!

DraftKings offered me 40% less, but I did get a hoodie

Why? This is a money making venture for the books. Think about it: what do DraftKings or FanDuel hope for when they present you with a cash-out button? Are they making you a generous offer out of the goodness of their hearts? Not in this lifetime!

This “feature” is offered to bettors (and probably got some VP a promotion) because it created so much shareholder value for the books. Don’t fall for the bait!

Loss Aversion and the Endowment Effect

Now that we’ve covered the basics of cashing out and hedging, and the mathematical costs to expected value that come with those activities, let’s consider psychological factors that make them easier or harder to resist.

Loss Aversion – this is a phenomenon in behavioral economics in which a real or potential loss feels more severe than an equal sized gain. For instance, the pain of losing $100 often exceeds the joy gained in finding the same amount. Because of this, bettors are apt to cash out or hedge winning positions in order to avoid negative feelings, costing themselves value on their best bets. By contrast, bettors rarely cash out losing positions because that would make their loss “real”.

While I’m heavily preaching a “rarely do this” approach to typical forms of hedging or cashing out, I’d much rather see readers cash out losing bets than hedge away value from winning propositions.

A bet that has declined in value since being made gives some signal, however small or random, that the team isn’t as strong as the initial bet presumed. At least when you’re cutting losers, you might accidentally be acting strategically. Cutting winners to lock in profits will be a big tax in the long run.

The Endowment Effect – another psychological finding that shows people value things they “own” more than those same things in the world, owned by others. A study found that people would pay much less to acquire an object than they would accept to sell that same object once they own it. I see this phenomenon happen with betting!

For example, let’s say you made a futures bet on the Commanders to win fewer than 7 games this season, at a great line, because of your hypothesis that rookie QBs always struggle. Then, you saw Jayden Daniels look like a super-skilled veteran in week one, proving the exception to the rule. If you remained attached to your prior position about the Commanders under, this is the endowment effect in action.

Don’t get blindly attached to your bets — especially those that will play out over time. Watch for your own endowment effect after choosing a side!

A rare time it might be correct to cash out or hedge, and pay the associated tax, shows up when you can identify a specific variable that changes and makes your prior bet unappealing. No one is watching your bets as closely as you, the books have wide exposure. When your expert knowledge can see something an algorithm doesn’t, I don’t want you to be frozen by the endowment effect – I endorse trusting your reads and making hedge-style bets against your position.

Specific Cases and Optimal Strategy

Now let’s look at some common situations a bettor may face and whether a hedge or cash out might be worthy.

The Last Leg of a 4+ Leg Parlay

Don’t cash out or hedge. Instead, change the way you bet parlays.

I know bettors who love making nine leg parlays for $10 that could hypothetically win $8,000. They treat them like lottery tickets, it’s a fun form of entertainment.

What they don’t consider, is that the final leg of the parlay, if they ever hit the first eight, has them betting $4,000 on a single game. They’d never fathom betting that much of their money on one outcome when starting from scratch!

This is a time people almost always hedge, costing themselves major expected value.

To avoid this, I recommend you reduce your parlay sizing to the point where you’re comfortable with the amount risked on the final leg. This creates free optionality.

If you win a big parlay during the day on Sunday, you can still bet all of your winnings on the night game if you so choose! My guess is that you won’t, and you’ll avoid the panicked hedge tax you’d have otherwise paid.

Futures Bets that are Looking Good

Don’t cash out, hedge sometimes.

Cashing out a futures bet just because it’s worth more than when you made it is a bad idea. As in our “Deal or no Deal” example, the price you’ll be offered is far below the true current value of your ticket. Hedging will nearly always give you more value if you must lower risk, and your bet meets one of our “good to hedge” scenarios below.

When might hedging work? Two common cases:

“Refinancing your bet” — I have found cases betting season-long futures where I can cash out a ticket for one amount, and gain upside by making the same bet with the cash out money at another sportsbook, essentially refinancing my odds.

For example, I bet Arizona to win their division before the season at 14-1. Here’s the ticket:

If another book was offering my +400 odds today, the $407.67 I’d get from BetMGM could be “refinanced” to win me more than $1600 rather than my current $1500 win payout.

Collecting profits on a long shot you never intended to ride all the way —You typically can’t find futures bets on college basketball teams to advance to the Elite Eight, or college football teams to reach their conference title game (win or lose). If you estimate an NCAA football team will reach their conference title game 5% of the time (20:1), and you can bet them to win the conference at 80:1, it’s worth making big bet knowing you can hedge the outcome of that game down the line, even though you’ll pay a tax to do so. The exact bet you wanted wasn’t available, so you took the best proxy.

Mid-game via Live Betting

Don’t cash out or hedge unless something unique happens to create an edge.

If you find yourself cashing out mid-game because of the size of your initial bet, as in our parlay example, instead start wagering amounts you can stomach losing. This is silly!

Books will not give you fair value in their live buyout offer — that should be clear by now.

If you find yourself betting to create a “middle” when your team gets off to a good start, remember that the live line should accurately reflect the shifted odds on the game, so this strategy will cost you money unless the in-game wager is a good bet on its own merit.

When you do spot a profitable live betting opportunity that goes against your initial bet, using Juice Reel to shop lines, don’t think of this as a hedge! You’re just making a new good bet with current information in that case. Vaya con dios!

Bet of the Week $$

Last week we made two trend-driven bets and went 1-1. We were correct about the Jets (!!) turning things around on Thursday night. While prime time unders went 2-1 last week, continuing profitability, we lost when the Chiefs gave up a last second TD to the Bucs before winning in OT. That one was brutal!

Even so, since starting the newsletter, bets given out in this section are ahead 3.1 units, at a positive 22% ROI. We’ll update this regularly.

Based on my research, I am making the following bets this week:

Under 53 points in the Bengals vs Ravens game Thursday night @-115 on Fanatics for 1 unit

LA Chargers -1 (teased from -7) + Arizona Cardinals +7.5 (teased from +1.5) @-120 on DraftKings for 1 unit

Broncos Money Line @+325 on BetRivers for 0.4 units

I like a Primetime Under tonight as both teams have been lucky in the red zone to date on their TD vs FG rates, and I think they will regress to the mean.

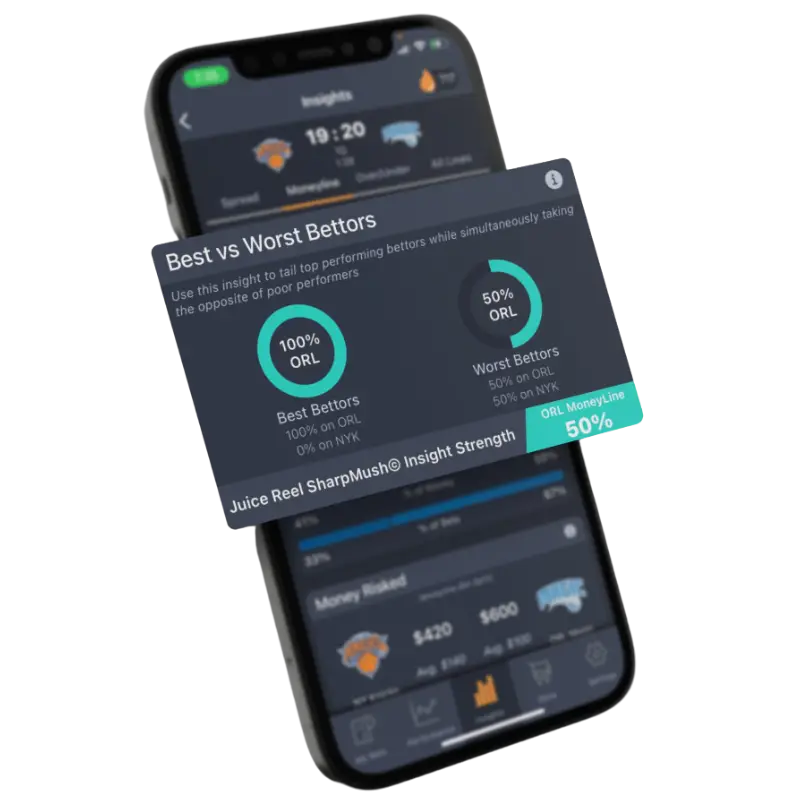

Over the weekend, I’ll bet a Wong teaser on two teams that have been playing well of late, and fade the money I see in Juice Reel’s SharpMush in predicting the Chiefs first loss of the year.

Explore More Betting Insights!

Have you tried the Juice Reel app? Besides the fact that it’s free to use, here are some of the features you’ll find in the app:

- Daily AI sports picks from our AI sports betting bot

- Community betting trends and consensus picks

- AI player prop bet predictions for every game so you can find the best PrizePicks today

- Best odds across 300+ sports books (onshore & offshore)

- Automatic bet syncing across all your sports book bets

- Live bet tracker (like a stock portfolio ticker)

- Sell your sports picks and find the best sports handicappers

Our website is great, but our app is better. The website is just a preview of what you can find in the free mobile app. Just the tip of the iceberg.

Download the free AI Sports betting app now to access all the sports betting data you can dream of. There is a reason Juice Reel has been crowned the “best sports betting tool”. Find out for yourself by clicking the button below.